Check-Off Salary

Advance

Bila Stress!

The most advance and convenient App to receive your Salary Advance. Pay conveniently too!

7+

Years In Business

300K+

Happy Clients

1,000,000

Loan limit

50+

Gov't Institutions being Served

See? Trust is Earned. You Can Rely on Us-Most Definitely!

Government Institutions

We Serve Government Employees across Kenya

Some of our happy customers include employees in the following institutions:

- TSC

- National Police Service

- National Government Ministries

- Government Parastatals

- County Government

Why Choose Us

Six Reasons why employers are confidently choosing Hela Pesa

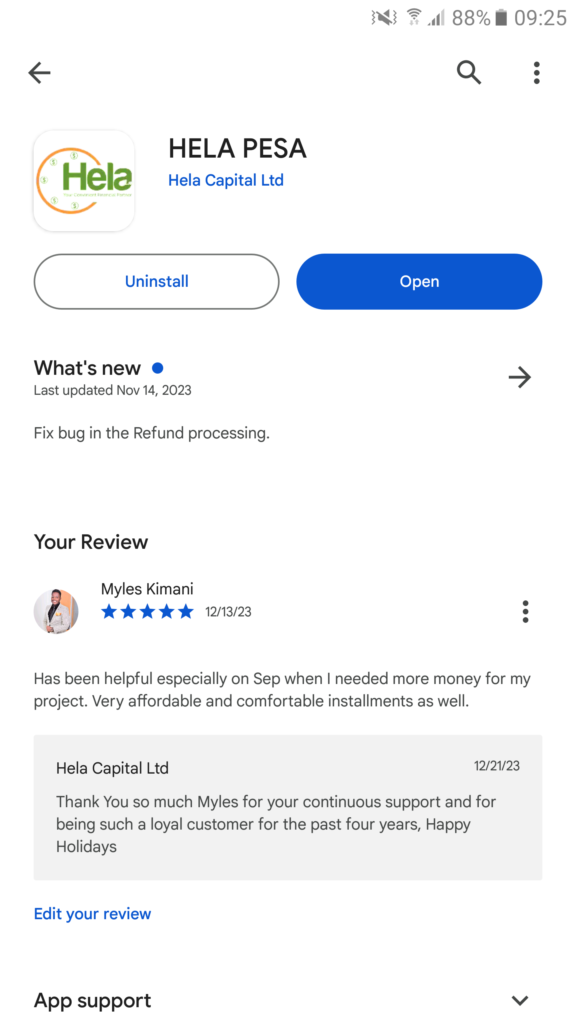

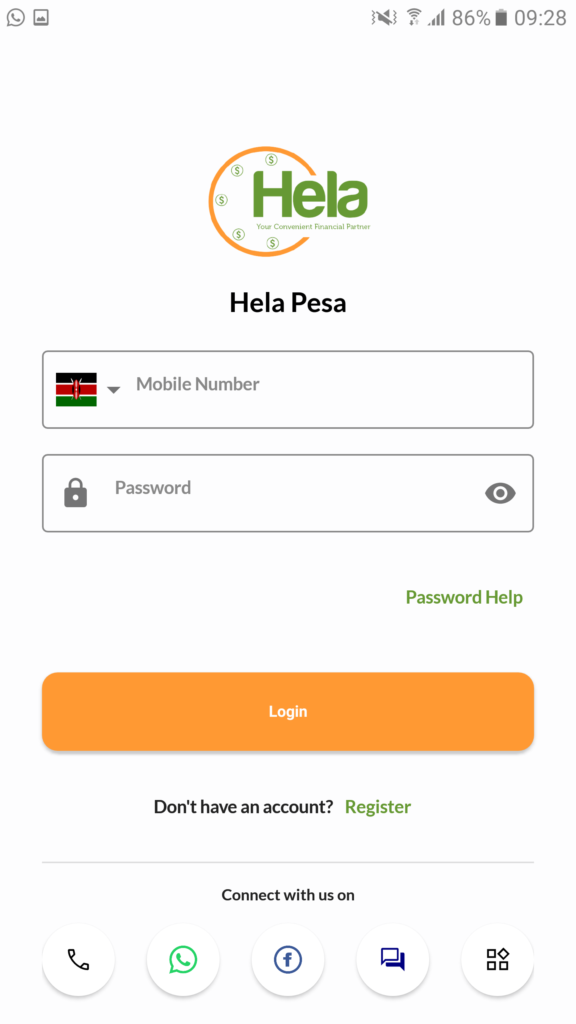

Easy to use App

User friendly and easy to navigate, making loan application process very smooth

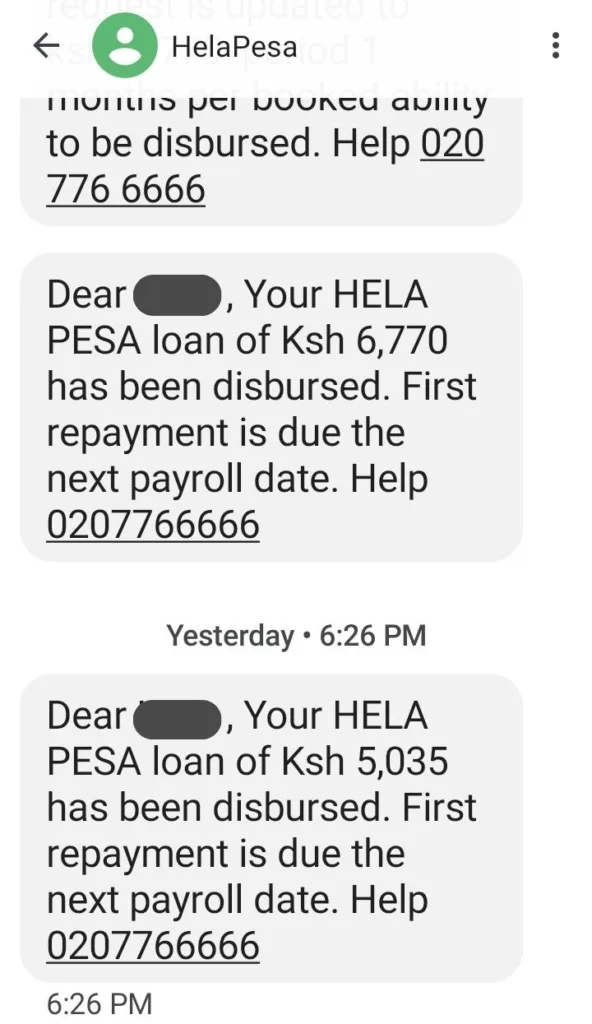

Quick Approval

Fast approvals that enable our customer to meet the financial need on time

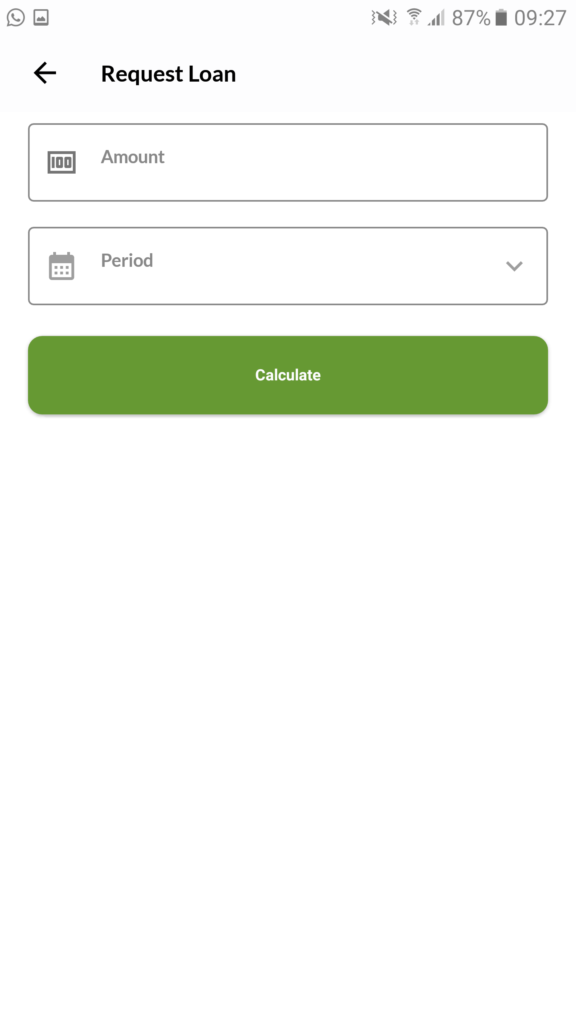

Flexible Loan Terms

You can chose check-off repayment time that is convenient for you, from 3-36 months

Security and Privacy

We value your privacy. Keeping your data private is a priority in Hela Pesa.

Quick Response

You can reach our customer support anytime of the day regardless of the platform .

Customer Support

Our Support team is available for all your queries and will assist you with any issue you might run into.

How to Apply for your salary advance using Hela Pesa App

Having any challenges?

Get in touch so with us so that we can assist you

Physical Location

Head Office

Feruzi Towers, Fourth Floor, Wing A

Kiambu Road, Opposite Quickmart Supermarket

Phone: 0207766666 Email: info@helapesa.com