A Reputation Built On Trust.

Hela Pesa stands as a proven partner in delivering dependable financial solutions to the nation's workforce in both National and County levels.

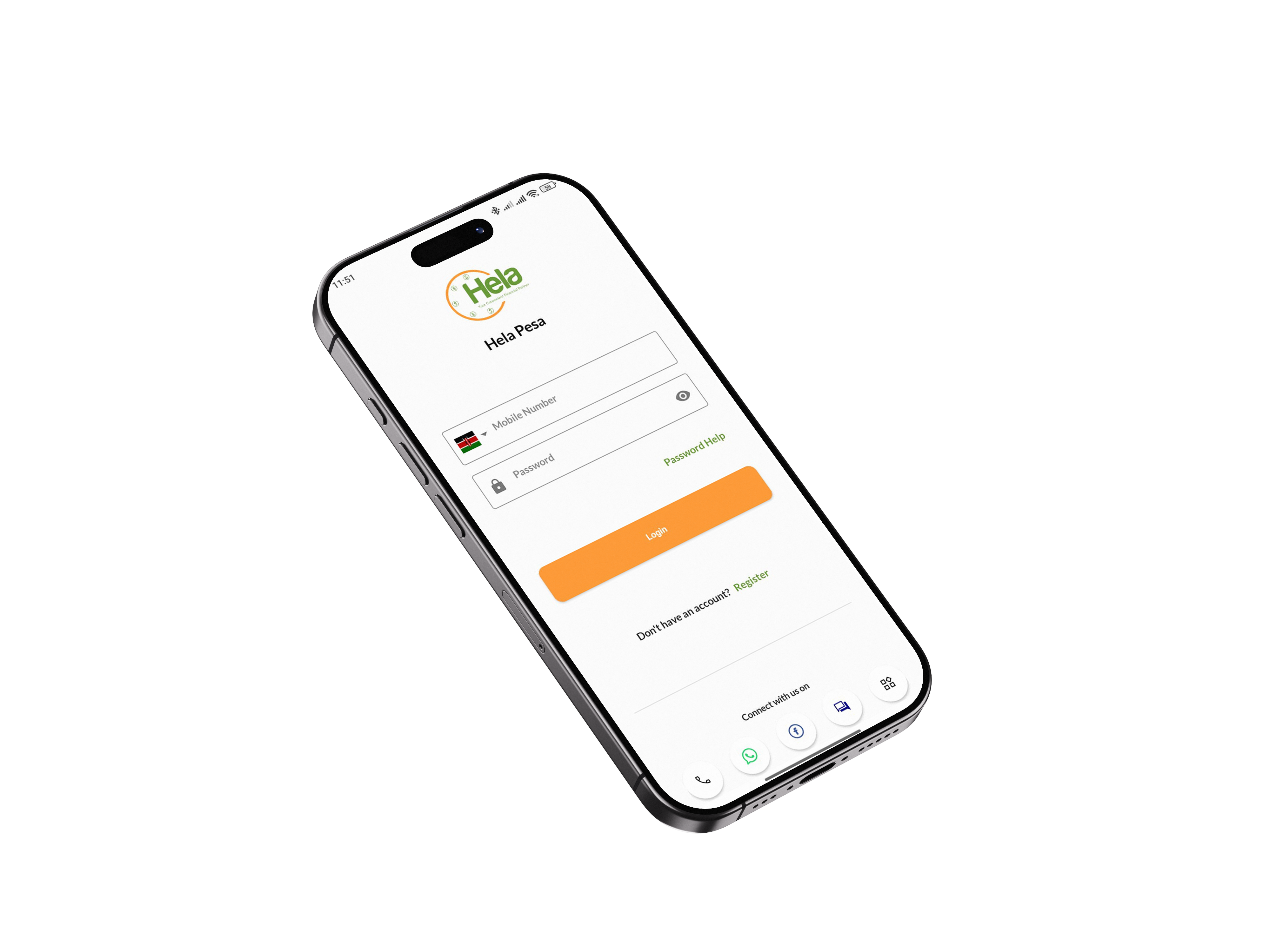

Application Ni Rahisi

Getting a loan is simple — just create your account, complete your profile, and submit your application. Once all your details and documents check out, we approve your request and send the funds directly to your M-Pesa.

Numbers Don't Lie

Hear from the people who trust us — real stories from civil servants across Kenya who've experienced fast, reliable, and stress-free financial support with Hela Pesa.

What our Customers Say about us

Real reviews from our satisfied customers

Trustpilot

Titus Ngaruiya

Verified Customer

“Other lenders have very exorbitant rates, but HELA PESHA is the king of the game and they deliver”

Trustpilot

Samuel Wahinya

Verified Customer

“Absolutely thrilled with my experience using Hela Pesa! The app's user-friendly interface made managing finances a breeze. The security measures in place also gave me peace of mind.”

Trustpilot

CPA K FM

Verified Customer

“As a teacher, I received my loan in less than an hour, so convenient of Hela pesa to address my distress timely”

Trustpilot

Stephen Otieno Asewe

Verified Customer

“HELA PESHA, thanks for approving my loan despite being listed with CRB. My emergency was sorted, I appreciate 🙏”

Trustpilot

Fiona Chebet

Verified Customer

“Thankfully, while searching for salary advance mobile loans on google I came across Hela Pesa. So friendly and user-ready”

Trustpilot

Ryan Tonny

Verified Customer

“Absolutely Fast and Safer than your ordinary Loan application. They have the best customer care services.”

Google Play

Clinton Kipng'etich

Verified Customer

“I love how fast and reliable it is.”

Google Play

Jane Mwangi

Verified Customer

“Great app for quick loans. The process is smooth and customer service is excellent.”

Trustpilot

Titus Ngaruiya

Verified Customer

“Other lenders have very exorbitant rates, but HELA PESHA is the king of the game and they deliver”

Trustpilot

Samuel Wahinya

Verified Customer

“Absolutely thrilled with my experience using Hela Pesa! The app's user-friendly interface made managing finances a breeze. The security measures in place also gave me peace of mind.”

Trustpilot

CPA K FM

Verified Customer

“As a teacher, I received my loan in less than an hour, so convenient of Hela pesa to address my distress timely”

Trustpilot

Stephen Otieno Asewe

Verified Customer

“HELA PESHA, thanks for approving my loan despite being listed with CRB. My emergency was sorted, I appreciate 🙏”

Trustpilot

Fiona Chebet

Verified Customer

“Thankfully, while searching for salary advance mobile loans on google I came across Hela Pesa. So friendly and user-ready”

Trustpilot

Ryan Tonny

Verified Customer

“Absolutely Fast and Safer than your ordinary Loan application. They have the best customer care services.”

Google Play

Clinton Kipng'etich

Verified Customer

“I love how fast and reliable it is.”

Google Play

Jane Mwangi

Verified Customer

“Great app for quick loans. The process is smooth and customer service is excellent.”

Trustpilot

Titus Ngaruiya

Verified Customer

“Other lenders have very exorbitant rates, but HELA PESHA is the king of the game and they deliver”

Trustpilot

Samuel Wahinya

Verified Customer

“Absolutely thrilled with my experience using Hela Pesa! The app's user-friendly interface made managing finances a breeze. The security measures in place also gave me peace of mind.”

Trustpilot

CPA K FM

Verified Customer

“As a teacher, I received my loan in less than an hour, so convenient of Hela pesa to address my distress timely”

Trustpilot

Stephen Otieno Asewe

Verified Customer

“HELA PESHA, thanks for approving my loan despite being listed with CRB. My emergency was sorted, I appreciate 🙏”

Trustpilot

Fiona Chebet

Verified Customer

“Thankfully, while searching for salary advance mobile loans on google I came across Hela Pesa. So friendly and user-ready”

Trustpilot

Ryan Tonny

Verified Customer

“Absolutely Fast and Safer than your ordinary Loan application. They have the best customer care services.”

Google Play

Clinton Kipng'etich

Verified Customer

“I love how fast and reliable it is.”

Google Play

Jane Mwangi

Verified Customer

“Great app for quick loans. The process is smooth and customer service is excellent.”

Ready to Get Started?

Join thousands of civil servants who trust Hela Pesa for their financial needs. Whether you need a Check-Off Loan for larger expenses or an Express Loan for quick cash, we've got you covered.