Mobile money has revolutionized the lending landscape in Kenya, providing quick and convenient access to loans. With just a few taps on a mobile app, individuals can secure funds for various purposes, such as emergencies, business ventures, or personal expenses.

These digital lenders leverage technology to streamline the loan application process, eliminating the need for lengthy paperwork and physical visits to traditional banks. They utilize algorithms and data analysis to assess creditworthiness swiftly, enabling borrowers to receive loan approvals within minutes.

Moreover, digital lenders offer flexible repayment terms tailored to individual needs. Borrowers can choose from short-term loans with higher interest rates or longer-term options with lower rates.

This flexibility has made loans more accessible to a wider range of Kenyans who may not have qualified for traditional bank loans due to stringent requirements.

Having said that, what are the top 5 loan Apps in Kenya in 2024?

If you need a loan in Kenya, it is crucial to understand the process and requirements to ensure a smooth and efficient application. Whether you are looking for a personal loan, business loan, or any other type of financial assistance, time is of the essence.

Here’s a list of the 5 Best Loan Apps in Kenya in 2023:

1. HelaPesa

HelaPesa is a leading salary advance loan app in Kenya that offers personal loans of up to KES 1,000,000. Hela Pesa specializes in giving loans to civil servants Iin Kenya. One of its key features is the fast loan disbursement process, with borrowers receiving their loans within minutes of approval.

To apply for a loan on HelaPesa, borrowers simply need to download the app and complete an online application form.

HelaPesa is a user-friendly app, which makes it easy for borrowers to track their loan status and receive money, with with no hidden fees or charges.

Read Also: 5 IMPORTANT Rules To Consider While Lending Money To Family And Friends

2. M-Shwari

M-Shwari is a digital banking service provided by NCBA Bank in collaboration with Safaricom, Kenya’s major mobile network operator. M-Shwari provides personal loans of up to KES 50,000 in addition to regular banking services such as savings accounts and money transfers.

Borrowers must have an M-Pesa account and be Safaricom subscribers to apply for a loan on M-Shwari. M-Shwari is widely available, as it is accessible to every Safaricom user with an M-Pesa account.

3. KCB M-Pesa

KCB M-Pesa is a joint venture between Kenya Commercial Bank (KCB) and Safaricom that offers a range of financial services through the M-Pesa mobile platform.

In addition to traditional banking services, such as savings accounts and money transfers, KCB M-Pesa also offers personal loans of up to KES 100,000.To apply for a loan on KCB M-Pesa, borrowers must have an M-Pesa account and be Safaricom subscribers.

Also Read: Simple ways to avoid defaulting on your loan

4. Branch

Branch is another well-known online borrowing app in Kenya, providing personal loans of up to KES 70,000. Branch is able to offer competitive interest rates and flexible payback options to qualified borrowers as a result of this.

Borrowers can apply for a loan on Branch by downloading the app and filling out an online application form.

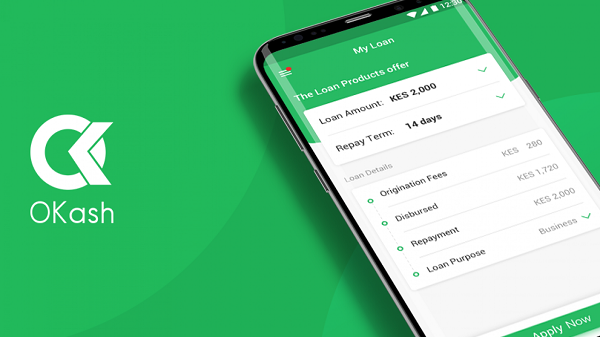

5. Okash

Okash offers personal and business loans in the amount of Ksh. 60,000. Install the app from the Google Play Store and register to receive the loans.

The Okash app calculates your loan limit and payback period based on the personal information you submit during registration. Okash loans have an annual interest rate of 14%.

In conclusion

Digital lenders have transformed the loan industry in Kenya by providing quick and accessible financial solutions. However, it is essential for borrowers to thoroughly research and understand the terms and conditions before engaging with any digital lending platform.